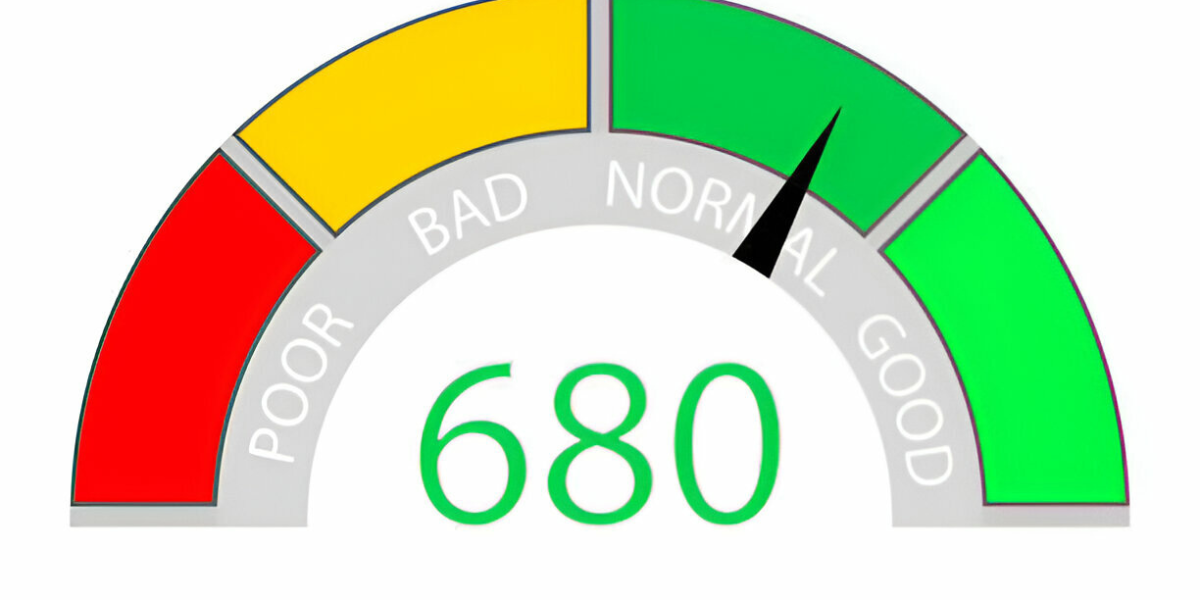

Credit has become one of the most important parts of modern financial life. Whether someone wants to rent a home, buy a car, qualify for a mortgage, or apply for a new credit card, lenders rely heavily on credit reports and credit scores. When inaccuracies or negative items appear on a report, they can make life difficult. That’s why credit repair continues to grow as a valuable service for individuals looking to rebuild their financial stability.

Credit repair focuses on correcting errors, disputing inaccurate information, and helping consumers understand how to develop positive credit habits. As the industry expands, it has also created opportunities for marketers, bloggers, and influencers—especially through the rise of the credit repair affiliate program, which connects consumers with trusted services while allowing affiliates to earn income.

Why Credit Repair Matters More Than Ever

Millions of people struggle with credit problems that aren’t fully their fault. Mistakes like outdated information, incorrect balances, duplicated accounts, or fraudulent activity can all harm a credit score. Many individuals don’t even realize there are errors on their reports until they face loan denials or higher interest rates.

Credit repair plays an important role by helping consumers:

-

Identify inaccurate entries

-

Dispute errors with credit bureaus

-

Remove outdated or unverifiable information

-

Understand how credit scoring works

-

Build better financial habits for the long term

This combination of correction and education helps people regain confidence and control over their financial future.

Growing Consumer Demand for Credit Repair Services

As interest rates rise and living costs increase, more consumers are actively checking their credit and looking for ways to improve it. Credit repair services have become a reliable option for individuals seeking accurate reporting and better financial opportunities.

Because the industry continues to expand, many digital creators have turned to the credit repair affiliate program model to monetize their platforms. This approach allows them to offer valuable guidance while earning commissions from each referred customer.

What Is a Credit Repair Affiliate Program?

A credit repair affiliate program allows affiliates to promote credit repair services using a unique referral link. When someone signs up through that link, the affiliate earns a commission.

Why people join these programs:

-

They’re free and easy to start

-

High demand means high conversion potential

-

The credit repair niche is evergreen

-

Affiliates receive marketing assets to promote services

-

It’s a meaningful way to help people improve their credit

For bloggers, YouTubers, and social media creators, this can become a steady source of passive income.

Credit Repair + Affiliate Marketing = A Win-Win

Consumers get access to tools that help them improve their credit scores, while affiliates get rewarded for connecting people with trusted services. This mutually beneficial setup is one reason the credit repair industry—and the affiliate programs tied to it—continues to grow year after year.

Final Thoughts

Credit repair gives people a second chance at financial stability. It helps remove inaccurate information, improves credit scores, and creates long-term opportunities. At the same time, marketers and creators can take advantage of industry growth by participating in a credit repair affiliate program. With strong demand and real impact, credit repair remains one of the most valuable and profitable niches in the financial world.